Congress just banned most hemp-derived THC products. What does that mean for RI beverage producers?

THC-infused beverages were the next big scene on the local craft scene, until the federal shutdown legislation brought the industry to a halt.

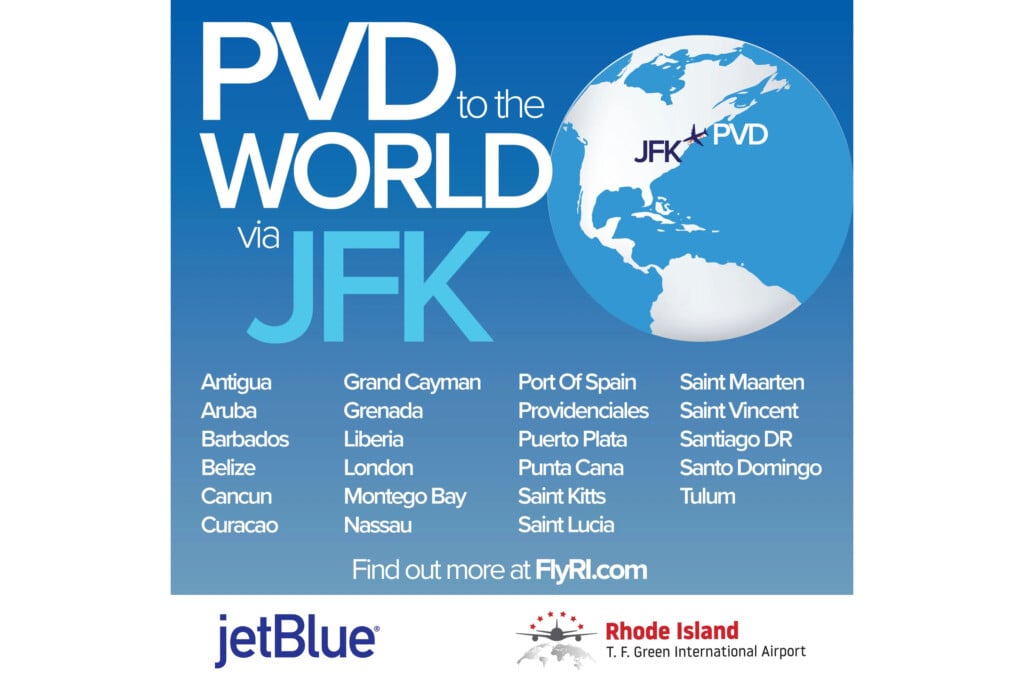

Float House, a Connecticut-based THC-infused beverage company that distributes in Rhode Island, is one of dozens of beverage producers set to be impacted by the federal ban on certain hemp-derived products passed by Congress this week. (Photo courtesy of Float House)

Wednesday’s government shutdown-ending legislation meant a sigh of relief for a large portion of Rhode Islanders: federal workers, food assistance recipients, anyone traveling on an airplane in the coming weeks.

But there’s a lesser-known impact of the deal to reopen the government that has an entire industry on edge. In a last-minute add-on to the funding bill approved on Wednesday, Congress updated the regulations around hemp-derived products, effectively banning anything containing more than 0.4 milligrams of THC. These include low-dosage, hemp-based gummies and edibles commonly sold at smoke shops or gas stations, as well as most of the THC-infused beverages sold in liquor stores.

Though the legislation is not slated to take effect for another year, the ban is already posing a roadblock to Rhode Island’s THC-infused beverage market, a quickly growing industry that’s made major inroads in the last year. Both in-state and out-of-state producers stand to lose out on what was expected to be the next big trend in adult beverages.

“It was disheartening to see them slip that in at the last minute, once everyone was exhausted with the budget,” says Dave Schiapo, co-owner of SmileGood Beverage Co., a THC-infused seltzer line that launched in Warwick in August. “There was a lot of emphasis around safety and age-gating, and I can’t speak for everywhere, but Rhode Island’s system has been working.”

A Hemp-Based Alternative to Alcohol

According to Adam Oliveri, CEO of Craft Collective Homegrown Beverage Distributors, consumers first started seeing THC-infused beverages widely available on the market around 2023. In 2018, the federal farm bill legalized hemp and its derivatives for commercial use. Since then, consumers have become accustomed to seeing products containing CBD, a non-intoxicating substance derived from hemp, at gas station checkouts and smoke shops. Hemp by law contains less than 0.3 percent THC by weight and is regulated separately from marijuana, the more potent form of cannabis sold in dispensaries in Rhode Island.

While the earlier hemp products contained little to no THC, over time, producers developed ways to increase its potency and create products that replicate the “high” of marijuana, albeit at lower levels. In Rhode Island, products regulated under a hemp consumables license are sold at liquor stores, smoke shops and other locations. Last year, the Department of Business Regulation officially recognized THC-infused beverages as a subcategory under hemp products and developed regulations for their production and sale.

“They’ve been very responsive to the changes and the fast-moving business of hemp-containing products being sold,” says Oliveri, whose company distributes THC-infused beverages along with craft beer and other alcoholic products.

For consumers, the THC-infused beverage market has emerged as an alternative for those who want to participate in the adult beverage scene without consuming alcohol. Gordon Whelpley is a co-founder of Float House, a Connecticut-based company that produces a nonalcoholic, THC-infused brew distributed in Rhode Island through Craft Collective Homegrown. Whelpley says his target customer is a lot like him — a craft beer enthusiast who doesn’t drink as much as they used to but still wants a beverage that offers a slight buzz without the after-effects.

“I like to think of them as a tired dad that’s going into the package store and buying a four-pack of double IPA and a six-pack of Athletic [nonalcoholic beer]. It’s the person who loves the flavor of beer but can’t hang like they used to be able to,” he says.

Schiapo, too, says his customer range tends to skew older. While there may be some overlap between THC-infused beverage consumers and dispensary customers, he believes his customers are looking for a lower-dose THC option, and many might not be regular cannabis consumers at all. It’s a distinction that’s led to some tension with dispensary owners, who tend to see THC products as something that should be regulated within their walls.

“These are capped at five milligrams [per can], so they’re very, very gentle. When you go to a dispensary, they’re going to [buy] a gummy that they’re buying fifty milligrams at a time. An average cannabis consumer, they don’t feel [the beverages] at all,” Schiapo says.

For liquor stores, the beverages are a new opportunity at a time of declining alcohol sales. Both liquor stores and craft breweries have seen shrinking consumption as many Americans choose to forego alcohol for health reasons or due to changing social norms. According to Oliveri, the twenty-one-plus beverages fit naturally in a liquor store environment while offering an alternative product.

“That’s kind of been our work in the past year is helping these liquor stores understand that this is another product that could help them serve the needs of their consumers,” he says. “These consumers are moderating their consumption of alcohol, and liquor stores are historically in the business of selling alcohol. They’re looking for nonalcoholic products and other things that can keep them in business.”

New Regulations in Rhode Island?

Even before Wednesday’s federal crackdown, THC-infused beverage companies faced challenges bringing their products to a national market. That’s because much like craft beer, hemp-derived beverage regulations differ significantly by state and were created piecemeal in response to a rapidly growing industry. In Rhode Island, THC-infused beverages are limited to five, one-milligram servings per can, and the cans must be resealable. In some other states, they’re limited to five milligrams per can (without the one-milligram serving limit), while still others limit them to ten or fifteen milligrams. Oliveri says Rhode Island’s “resealable” requirement is an outlier among state regulations, one that makes it difficult to recruit more brands to sell in Rhode Island.

“It drives down consumer choice, because there’s only so many vendors that can comply with that rule,” he says.

Earlier this year, state legislators considered bills to either ban or further regulate hemp-derived, THC-infused beverages in Rhode Island. Ultimately, the proposals were held for further study, and the state Cannabis Control Commission was asked to study the issue and come up with new regulatory recommendations by March of next year. Among the factors the agency is looking at are dosage, labeling, licensing and consumption-venue issues, according to Charon Rose, spokesperson for the CCC.

At the same time, the state has pulled back on allowing THC-infused beverage sales for onsite consumption. While restaurants and bars that already had a hemp consumables license are still allowed to sell the beverages to patrons twenty-one and older, the CCC placed a moratorium on new retail licenses for businesses that allow onsite consumption as of July 18. That means restaurants and bars can’t add the beverages to their menus until the issue is resolved.

With the looming federal ban now complicating matters, Rose released the following statement:

“The Commission is aware of recent federal developments concerning hemp and hemp-derived products and continues to closely monitor the situation in Washington, D.C. At this time, it is too soon to determine what impact these developments may have on Rhode Island. We remain committed to keeping stakeholders and the public informed as more information becomes available.”

A Path Forward

The federal ban on the surface appears catastrophic for an industry that’s still in its early years. However, many of the companies Rhode Island Monthly spoke with for this story were hopeful the controversy generated by the legislation might result in new, nationwide regulations before the ban takes effect next year. Whelpley points out the ban could have implications beyond THC-infused products and effectively restrict sales of CBD, a product customers are now used to seeing on shelves.

“It’s a $28 billion industry employing directly over 330,000 people in this country. That’s a lot,” he says.

Whelpley and his business partner Jared Emerling say they’re not opposed to regulation and would welcome federal measures that streamline the standards for THC-infused beverages across states. In the meantime, they plan to stay active in the legislative process and advocate to keep the products on the market.

Schiapo is also hopeful his fledgling company won’t be forced to close after a little more than a year in business. He says farmers, distributors and suppliers are coming together to push for a different solution than the federal ban.

“A lot can happen in a year, and we’re hopeful for a resolve before that year runway ends. In the meantime, we keep pushing forward, keep talking to customers and educating them on this option that so many have found to be helpful. At the end of the day, it’s them being punished and their choices taken away.”

For more details on what happened in the final hours before the hemp-derived THC vote and where Rhode Island’s congressional delegation stands, check out this excellent breakdown by Rhode Island Current reporter Christopher Shea.